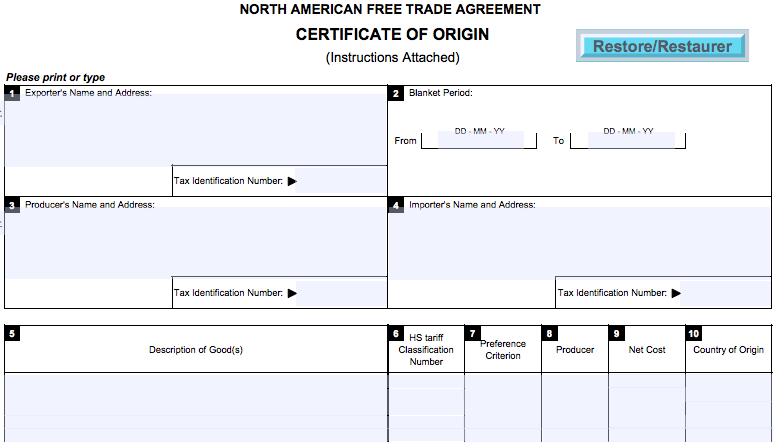

Certificate of Origin

The NAFTA Certificate of Origin tells us the Country of Origin of your imported goods. Both buyers and sellers use the certificate at customs to prove the Country of Origin. Remember, by proving that the goods are from NAFTA, you may pay little or no duties.

The NAFTA Certificate must be used when the total value of your shipment exceeds $ 2, 500 USD. It is the exporter’s responsibility to provide the importer with a valid NAFTA Certificate of Origin.

When the producer of the goods is not the exporter, the producer may still complete the certificate of the exporter but a separate certificate is still required to be completed by the exporter.